Survey: How the Pandemic Alters Americans’ Financial HabitsThe coronavirus pandemic has thrown millions of Americans into chaos, negatively affecting financial well-being alongside physical and mental health. As unemployment rates soar and money insecurities abound, a new NerdWallet survey finds almost half of Americans (48%) are indeed feeling less confident about their personal finances due to COVID-19. In a survey of more than 2,000 U.S. adults commissioned by NerdWallet and conducted online by The Harris Poll, we asked Americans how COVID-19 is affecting their finances — including spending and saving habits, feelings about homebuying and investing, and money plans for the end of the pandemic. Key findings

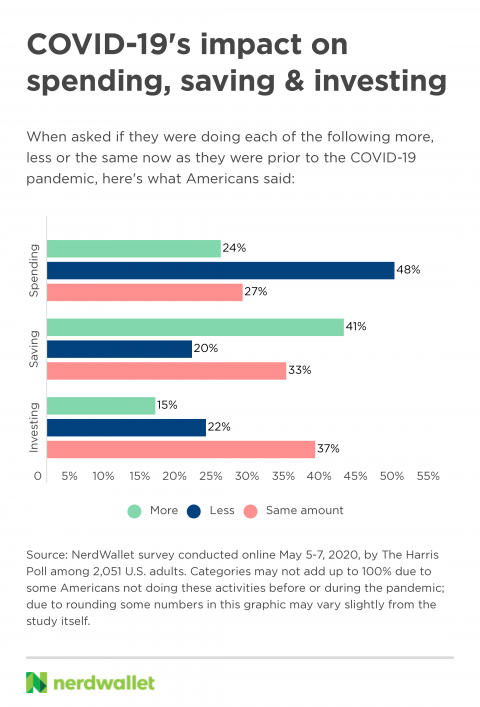

Pandemic affecting how we save and spendCOVID-19 has changed more than social behavior; it’s also changed financial behavior. Overall, Americans say they’re saving more and spending less. Roughly 2 in 5 Americans (41%) say they’re saving more money now than they were prior to the COVID-19 pandemic, with younger Americans more likely to say this than their older counterparts. Around half of Gen Zers (50%) and millennials (52%) are saving more than they were before compared with 39% of Gen Xers (ages 40-55) and 29% of baby boomers (ages 56-74). Close to half of Americans (48%) report spending less now than they were pre-pandemic, and 36% have changed how much they’re investing.

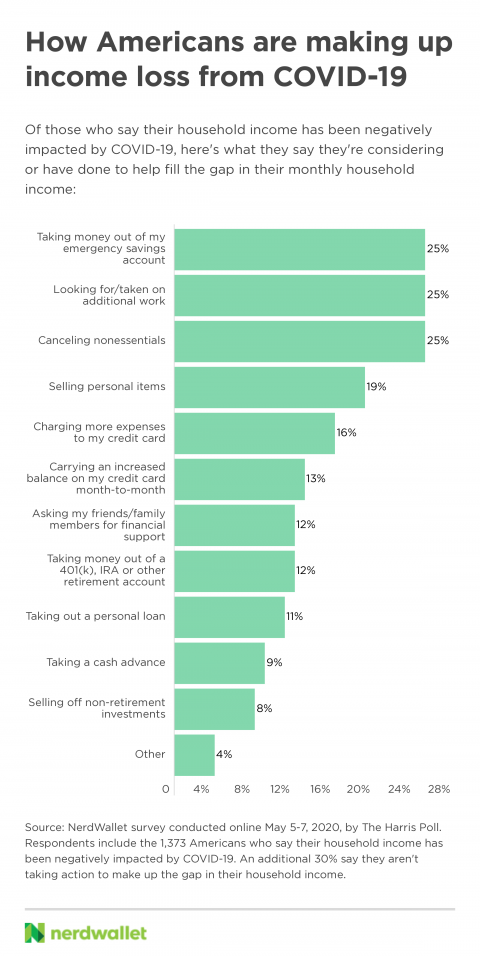

Likely due to a combination of financial instability and lack of access to spend on the things we spent on before, almost all Americans (94%) report spending less money on certain expenses during the COVID-19 pandemic. More than 3 in 5 each say they’re spending less on shopping (63%), restaurant food (62%) and transportation (62%). Over half (56%) are spending less on entertainment and 45% have cut back on personal care spending. Close to 3 in 10 Americans who have children under the age of 18 (28%) say they’re spending less on child care. While plenty of Americans are spending less, many are also spending differently under the circumstances. Close to 2 in 5 Americans (37%) say they’ve made more of an effort to support local businesses and 35% report tipping more for takeout and delivery of restaurant food and groceries. Around 1 in 6 Americans (16%) have donated to COVID-19 relief efforts, like contributing to GoFundMe campaigns for affected people and businesses. In times of financial unease, cutting back on nonessentials is a smart move, particularly if you aren’t comfortable with the amount you currently have saved or you’re worried about job security. If you’re in the fortunate position to do so, it’s a good idea to use the money that’s not being spent on unnecessary purchases to beef up your savings. Consider it a temporary measure to increase your peace of mind in case you experience income loss or unexpected expenses in the future. Of course, if you have the means, you could also help others who aren’t as fortunate. “If you have built up a comfortable emergency fund and you are still earning income, then you may want to consider supporting local small businesses by purchasing gift cards to use at a future date or donating to your community food bank,” says Kimberly Palmer, personal finance expert at NerdWallet. Many trying to combat income lossMillions of Americans are feeling the COVID-19 pandemic’s effect on their incoming cash — more than two-thirds of U.S. adults (69%) say their household income has been negatively impacted. Of them, 70% have either taken action to fill their monthly income gap or have at least considered it. A quarter of Americans whose household income has been negatively affected by COVID-19 (25%) say they’re considering taking or have taken money out of their emergency savings account to help fill the income gap. A quarter have looked for/taken on additional work (25%), and a quarter have canceled nonessentials (25%), or at least considered it.

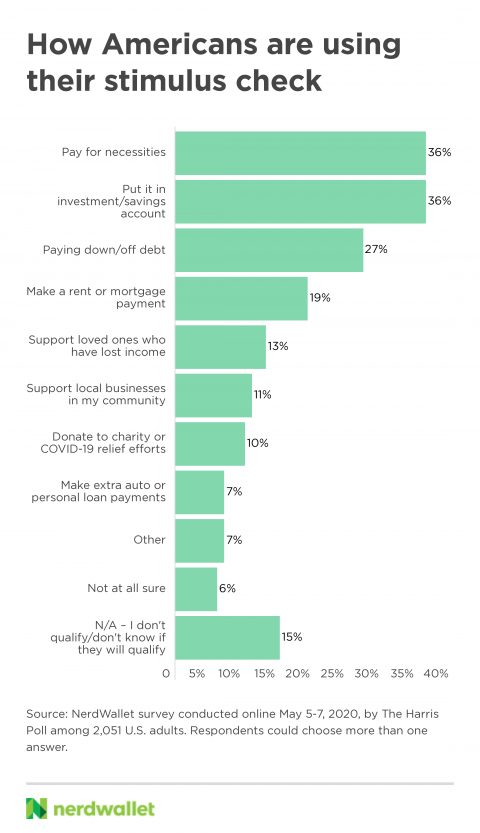

Job loss can be a traumatic experience, particularly when it’s due to circumstances outside of a person’s control, like a pandemic. “Losing income, even temporarily, is one of the most financially stressful things that can happen to a person. Applying for unemployment benefits, looking for new jobs and relying on savings can help you get through the crisis,” Palmer says. Relief checks going toward necessities, padding savingsAs part of the CARES Act, many Americans have or will receive a stimulus check from the federal government. When asked how they plan on using theirs or have used theirs, more than a third of Americans (36%) reported they plan to use/have used it to pay for necessities, and the same proportion (36%) said they plan to save or invest it, or already have.

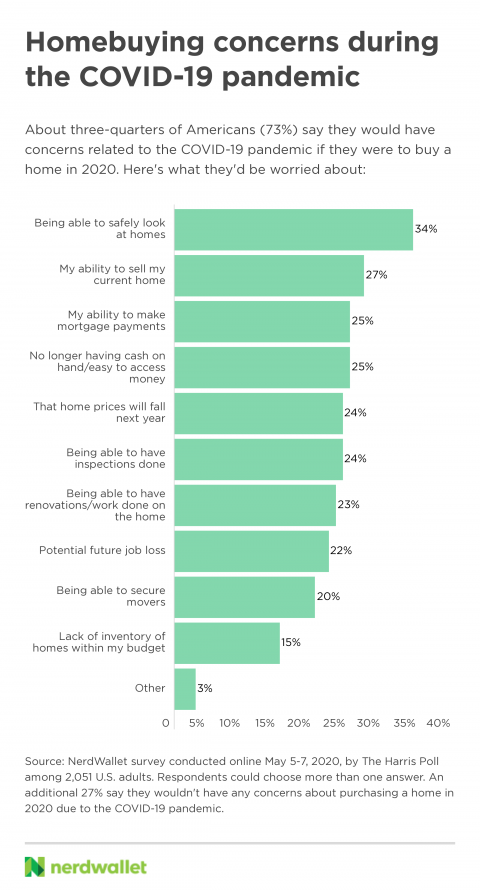

The best way to spend this money is highly dependent on your personal circumstances, but if you haven’t received or used your stimulus payment yet, check out NerdWallet’s guide on how to prep for and spend your relief check. It could help you think through how to use this cash to improve your financial situation, and potentially to help others as well. Thinking differently about homebuying, travel insurance and investingIn addition to its impact on their everyday financial lives, the COVID-19 pandemic is also changing how Americans think about purchasing a home, insuring their leisure travel, and investing. Homebuying: More than 1 in 5 Americans (22%) planned to buy a home in 2020, but some have since changed their plans. Of these potential home buyers, 35% still plan to buy this year, 30% no longer plan to buy in 2020 and another 35% aren’t sure if they will. Unsurprisingly, there’s some apprehension about buying a home this year. About three-quarters of Americans (73%) say they’d have concerns about buying a home in 2020 due to the COVID-19 pandemic. Some worries are regarding safety, but there are also financial concerns, like the ability to make mortgage payments (25%) or no longer having cash on hand (25%).

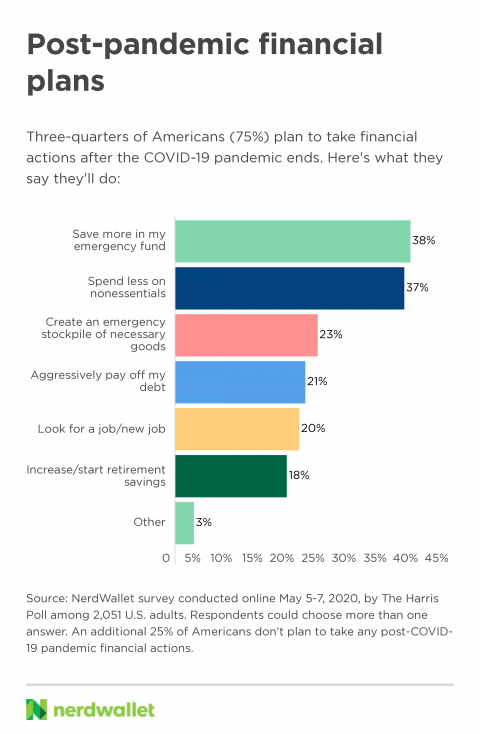

Travel insurance: With the coronavirus pandemic canceling so many travel plans, many Americans are rethinking their stance on trip insurance, which can help reimburse your costs in the event you have to scrap upcoming travel. One in 5 Americans (20%) say they’ve purchased travel insurance for leisure trips prior to COVID-19 and 15% have considered it, but ultimately decided not to purchase. However, almost half of Americans (45%) say they’re likely to purchase travel insurance for future leisure trips after the pandemic. While travel insurance can be a great way to mitigate risk in case of illness, it’s important to understand the limitations. For example, “fear of travel” is generally not covered. In other words, while actually falling sick is a covered reason to cancel an insured trip, fear of getting sick probably isn’t. Investing: Stock market volatility is common in times of uncertainty, and the COVID-19 pandemic is no exception. More than a quarter of American investors (26%) say they invested money in companies or industries that fell in value during the pandemic, and 1 in 5 investors (20%) rebalanced their portfolio to adjust for current events. Around 1 in 8 sold off investments in each of these cases: because they were worried about market volatility (13%) or to pay for necessities (12%). “Since no one can time the market, it’s generally a good idea to stick with your investing strategy and not make any big changes, even when the market is experiencing a lot of swings. As long as you are comfortable with your mix of investments and they make sense based on your risk tolerance and age, then it can be a good idea to ride out these daily fluctuations instead of reacting to them,” Palmer says. Saving more, spending less after COVID-19 endsNot everyone has the ability to make financial changes while in this difficult period, but many are making plans for after the pandemic ends. Three-quarters of Americans (75%) plan to take financial action after COVID-19, the most popular being saving more in an emergency fund (38%) and spending less on nonessentials (37%).

“The pandemic has upended many Americans’ sense of control over their lives. One way to regain a sense of normalcy is to control what we can by increasing our savings, paying off high-interest-rate debt and scaling back unnecessary spending. A padded emergency fund can provide the balm we need to get through difficult times and rebuild our lives afterward,” Palmer says. MethodologyThis survey was conducted online within the United States by The Harris Poll on behalf of NerdWallet from May 5-7, 2020, among 2,051 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Chloe Wallach at cwallach@nerdwallet.com. |

|

Routing #: 221379824